We are committed to reducing the energy consumption and greenhouse gas emissions from our buildings, playing our part in the global energy transition and the shift to a low-carbon economy. This commitment is guided by the scientific imperative of avoiding dangerous climate change by limiting global warming to below 2 degrees Celsius.

We consider our actions to eliminate emissions to be the most significant contribution we can make to climate change mitigation.

2022 Performance Highlights

-

As part of GPT's net zero plans, 20 of GPT's operationally controlled assets in which we have an ownership interest are Climate Active Carbon Neutral (for Buildings) certified. Four are operating carbon neutrally with certification due in 2023.

-

GPT is also driving an orderly transition to a low carbon economy and improving its asset's resilience to this transition. The Carbon Neutral Certified Chirnside Park Shopping Centre is home to GPT's first Smart Energy Hub in partnership with Shell Energy Australia and includes the investment in a 650 kW solar PV array, a 2 MWh battery, and a loadflex program that flexibly responds to grid supply constraint while lowering energy costs.

-

As at Dec 2022, there was 6.3 MW of solar photovoltaic arrays across the portfolio.

- The Group's Office portfolio delivered a a 5.1 Star Weighted Average NABERS Energy Rating (without GreenPower) and the Group's Retail portfolio delivered a 4.5 Star Weighted Average NABERS Energy Rating (without GreenPower).

- The Group has reduced its carbon emissions intensity (Scope 1 and 2 net offsets) by 86 percent and energy intensity by 52 percent against our 2005 baseline.

- Continued asset-level climate hazard identification and adaptation planning across the portfolio, including for new acquisitions and developments.

|

Performance Data |

2005 |

2021 |

2022 |

2022 |

2023 |

|

|---|---|---|---|---|---|---|

|

Energy |

||||||

|

Energy Intensity |

571 |

257 |

294 |

269 ✔ |

275 |

MJ/m2 |

|

Total Energy |

999,560 |

483,669 |

|

508,539 |

|

GJ |

| Renewable energy | -- | 195,629 | 232,701 | GJ | ||

| Non-renewable energy | 999,560 | 288,040 | 275,838 | GJ | ||

|

Emissions |

||||||

|

Emissions Intensity |

136 |

25 |

28 |

19✔ |

15 |

kg CO2-e/m2 |

|

Total Net Emissions (Scope 1 and 2)* |

238,750 |

47,506 |

|

35,238 |

|

t CO2-e |

|

Scope 1 Emissions |

7,578 |

7,799 |

|

8,806 |

|

t CO2-e |

|

Scope 2 Emissions (market-based) |

231,172 |

48,907 |

|

36,801 |

|

t CO2-e |

|

Scope 2 Emissions (location-based) |

231,172 |

86,589 |

|

86,711 |

|

t CO2-e |

| Scope 3 Emissions | NR | 23,148 | 24,156 | t CO2-e | ||

| Carbon offsets | 0 | -16,834 | -10,369 | t CO2-e | ||

| Office portfolio NABERS rating (without GreenPower) | -- | 5.2 | 5.0 | 5.1 ✔ | 5.0 | Star |

| Climate Active certified corporate operations | -- | Carbon neutral | Maintain | Carbon neutral ✔ |

Maintain |

* Net emissions are the sum of Scope 1 plus Scope 2 market-based emissions minus a portion of associated carbon offsets.

Find out more about GPT's performance in the 2022 Sustainability Report.

Our 2022 Climate Disclosure Statement sets out the steps we are taking to identify, assess and manage climate change risks and opportunities in accordance with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations.

The GPT Environment Dashboard (previously the Environment Data Pack) details the full performance of our portfolio, assets and wholesale funds since 2005, including building ratings and attributes.

Policy and Approach

GPT's Climate Change and Energy Policy sets out our commitments and approach to managing energy, emissions and climate change.

Our actions to reduce energy consumption and emissions are driven by GPT’s Energy Master Plan. The Plan sets out how we will achieve our carbon neutral targets and mitigate risk by reducing energy costs and energy price volatility, leveraging innovative technology to increase supply reliability, engaging partners, and strengthening our energy procurement capabilities.

In managing our asset portfolio, we monitor and assess climate adaptation risks and opportunities for each asset and take account of these in our investment decisions.

We work with our supply chain partners, including our customers, external building managers and critical suppliers, to influence their energy use and practices. Where possible, we share objectives and targets with these external partners.

Through membership and participation in industry organisations including the Property Council of Australia, Green Building Council of Australia and the City of Sydney Better Building Partnership, GPT participates in climate change public policy development.

Delivering positive climate and energy outcomes

GPT monitors our energy and emissions performance through our ISO14001 certified Environmental Management System.

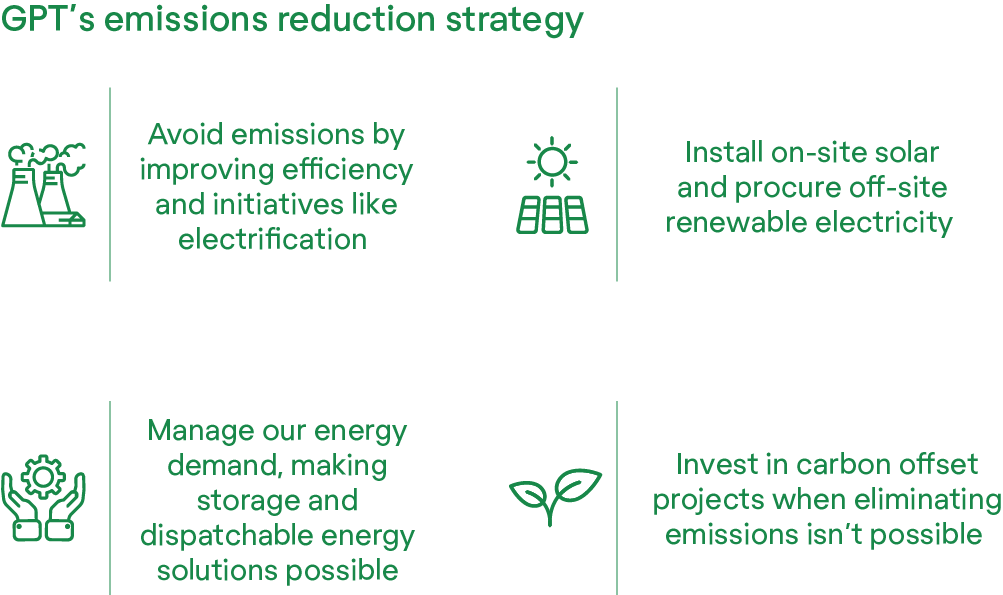

Within each asset and across the portfolio we implement the GPT Energy Master Plan. The Energy Master Plan delivers carbon neutrality through initiatives that eliminate emissions (energy efficiency, electrification, renewable installation and procurement), and support for the grid, partners and the planet where we cannot eliminate (demand management, carbon removal investments and offsets). Some examples of key initiatives include:

Targets, monitoring and metering

- Establishment of monitoring and baselines for all assets, both existing and newly acquired or developed assets;

- Targets are set annually for each asset, taking account of improvement plans and performance, and we monitor and report this internally through the year;

- Management KPIs and incentives are aligned with environmental performance targets;

- Site teams are provided with training to micro-monitor performance and calibrate systems for optimal efficiency;

- Minimum requirements are integrated into the development of new assets and considered in initial environmental reviews for newly acquired assets;

- Metering systems are installed and systems continuously commissioned to ensure systems maintain efficiency;

- Sub-metering enables allocation of consumption costs on a user-pays basis at an increasing number of sites.

Energy efficiency

- Use of energy efficient appliances in new developments;

- Efficiency upgrades, such as lighting replacements, installation of separate switches, installation of PE cells, and use of sensors - like a portfolio-wide lighting analysis and LED upgrade program across the retail portfolio in 2015 and 2016, estimated to save over $900,000 every year;

- GPT’s lifecycle assessment process for capital expenditure in managed assets prioritises environmental performance as one of 3 key deliverables, focusing employees and consultants on finding the optimal solution for ongoing performance and replacing equipment with better arrangement, strategy or efficiency as part of normal maintenance and capital programs, like the use of variable speed drives;

- Changing the start/stop time on the mechanical plant (especially air-conditioning plant) to best match occupant needs;

- Use of sub-metering and analytics systems to monitor, profile and detect equipment inefficiencies.

Passive and renewable energy

- Use of passive forms of energy and natural ventilation where possible, like at Rouse Hill Town Centre where the Building Management System adjusts shades to optimally use the sun for warmth and lighting;

- Installation of solar PV systems and a rolling assessment of business case analysis for existing assets. Find out where we have installed and operate solar pv in the GPT Environment Data Pack;

- Purchase of government-accredited renewable GreenPower, which is additional to any grid renewables;

- Implementation of on-site energy production through co- or tri-generation technology, which provides electricity as well as heating and cooling (for tri-generation) efficiencies. Find out where we generate energy on-site through co- or tri-generation in the GPT Environment Data Pack.

Supporting tenants, communities and the environment

- Green leases, fitout guides and minimum standards to reduce tenant GHG emissions;

- Holding Building Management Committee meetings to provide information to tenants on building performance and how the tenant space interacts;

- Sharing news, guides and training to building operations teams, occupants and tenants to enable them to stay up to date on emerging best practices;

- Demand response programs to make storage and dispatchable energy available to the grid during times of stress;

- Investment in carbon removal reforestation projects across Australia through our partners GreenFleet for residual emissions at carbon neutral certified sites that also have biodiversity and local employment co-benefits;

- Delivering ongoing carbon neutral operations for GPT's business operations, including our head office, state offices, management offices and GPT's Space & Co business - GPT has been a Climate Active certified carbon neutral organisation since 2011;

- GPT actively participates in industry bodies and programs like the Better Buildings Partnership to support and encourage continued innovation;

- Site tours to renewable energy plants to aid education and awareness on how 'green' electricity is produced.

Increasing resilience and adapting to climate change

- Monitoring and assessing physical and transitional risks arising from the impact of climate change as part of GPT investment and portfolio management decisions;

- Integrating climate change into investment analysis, due diligence and decision-making, including for all new developments and acquisitions or mergers;

- Conducting asset-level climate hazard identification and adaptation planning for all operational assets;

- GPT mitigates the risk of a carbon price through our energy efficiency program while any increased costs of electricity and gas creates a greater incentive for energy efficiency and renewable energy projects. For internal purposes, the cost of energy efficiency, renewable energy and carbon offsets provide an internal metric for costing the Group’s achievement of its carbon neutral commitments.

Find out more about GPT's performance in the 2022 Sustainability Report.