Components for Annual Tax Returns

The following information is provided to assist investors in managing their tax affairs relating to their investment in GPT.

Group Distribution Summary

GPT paid the following distributions to Securityholders during the year ending 30 June 2025:

| Period Ended | Payment Date | Cents per Security |

|---|---|---|

| Half year ended 30 June 2024 | 30 August 2024 | 12.00 |

| Half year ended 31 December 2024 | 28 February 2025 | 12.00 |

Annual Tax Statements

The Annual Tax Statement for the year ending 30 June 2025 has been provided to investors. The components of the distribution on a cents per security basis for the year are provided below:

| Period Ended | 30 Jun 2024 | 31 Dec 2024 | Total Distribution | Total Distribution (%) |

|---|---|---|---|---|

| Rate (cents per security) | 12.00 | 12.00 | 24.00 | 100.00% |

| Australian Assessable income (interest income) | 0.403981 | 0.482081 | 0.886062 | 3.69% |

| Australian Assessable income (other income) | 5.135456 | 5.290907 | 10.426363 | 43.45% |

| Net capital gain (Discounted TAP) | 4.762060 | 0.242646 | 5.004706 | 20.85% |

| Non-Assessable Amount | 1.698503 | 5.984366 | 7.682869 | 32.01%1 |

| Total Distribution paid | 12.000000 | 12.000000 | 24.000000 | 100.00% |

1. This represents the tax deferred for the trust which may be slightly different to the tax components for an individual investor.

Group Distribution Summary

GPT paid the following distributions to Securityholders during the year ending 30 June 2024:

| Period Ended | Payment Date | Cents per Security |

|---|---|---|

| Half year ended 30 June 2023 | 31 August 2023 | 12.50 |

| Half year ended 31 December 2023 | 29 February 2024 | 12.50 |

Annual Tax Statements

The Annual Tax Statement for the year ending 30 June 2024 has been provided to investors. The components of the distribution on a cents per security basis for the year are provided below:

| Period Ended | 30 Jun 2023 | 31 Dec 2023 | Total Distribution | Total Distribution (%) |

|---|---|---|---|---|

| Rate (cents per security) | 12.50 | 12.50 | 25.00 | 100.00% |

| Australian Assessable income (interest income) | 0.729549 | 0.501245 | 1.230794 | 4.92% |

| Australian Assessable income (other income) | 4.409208 | 3.545602 | 7.954810 | 31.82% |

| Net capital gain (Discounted TAP) | 2.625542 | 0.641690 | 3.267232 | 13.07% |

| Non-Assessable Amount | 4.735701 | 7.811463 | 12.547164 | 50.19%1 |

| Total Distribution paid | 12.500000 | 12.500000 | 25.000000 | 100.00% |

1. This represents the tax deferred for the trust which may be slightly different to the tax components for an individual investor.

Investors who received a distribution which was reported in their GPT 2024 Tax Statement (issued on 29 February 2024) are required to complete a Trust Income Schedule 2024 and lodge it with their tax return. A supplementary guide which can be found here has been prepared to assist investors in completing the Trust Income Schedule 2024 in relation to their GPT securities.

Group Distribution Summary

GPT paid the following distributions to Securityholders during the year ending 30 June 2023:

| Period Ended | Payment Date | Cents per Security |

|---|---|---|

| Half year ended 30 June 2022 | 31 August 2022 | 12.70 |

| Half year ended 31 December 2022 | 28 February 2023 | 12.30 |

Annual Tax Statements

The Annual Tax Statement for the year ending 30 June 2023 has been provided to investors. The components of the distribution on a cents per security basis for the year are provided below:

| Period Ended | 30 Jun 2022 | 31 Dec 2022 | Total Distribution | Total Distribution (%) |

|---|---|---|---|---|

| Rate (cents per security) | 12.70 | 12.30 | 25.00 | 100.00% |

| Australian Assessable income (interest income) | 0.205785 | 0.304668 | 0.510453 | 2.04% |

| Australian Assessable income (other income) | 6.724253 | 5.573187 | 12.297440 | 49.19% |

| Net capital gain (Discounted TAP) | 0.934327 | 0.790606 | 1.724933 | 6.90% |

| Non-Assessable Amount | 4.835635 | 5.631539 | 10.467174 | 41.87%1 |

| Total Distribution paid | 12.700000 | 12.300000 | 25.000000 | 100.00% |

1. This represents the tax deferred for the trust which may be slightly different to the tax components for an individual investor.

Group Distribution Summary

GPT paid the following distributions to Securityholders during the year ending 30 June 2022:

| Period Ended | Payment Date | Cents per Security |

|---|---|---|

| Half year ended 30 June 2021 | 31 August 2021 | 13.30 |

| Half year ended 31 December 2021 | 28 February 2022 | 9.90 |

Annual Tax Statements

The Annual Tax Statement for the year ending 30 June 2022 has been provided to investors. The components of the distribution on a cents per security basis for the year are provided below:

| Period Ended | 30 Jun 2021 | 31 Dec 2021 | Total Distribution | Total Distribution (%) |

|---|---|---|---|---|

| Rate (cents per security) | 13.30 | 9.90 | 23.20 | 100.00% |

| Australian Assessable income (interest income) | 0.244600 | 0.227396 | 0.471996 | 2.0% |

| Australian Assessable income (other income) | 7.238098 | 5.246795 | 12.484893 | 53.8% |

| Net capital gain (Discounted TAP) | 1.529197 | 0.300288 | 1.829485 | 7.9% |

| Non-Assessable Amount | 4.288105 | 4.125521 | 8.413626 | 36.3%1 |

| Total Distribution paid | 13.300000 | 9.900000 | 23.200000 | 100.00% |

1. This represents the tax deferred for the trust which may be slightly different to the tax components for an individual investor.

Group Distribution Summary

GPT paid the following distributions to Securityholders during the year ending 30 June 2021:

| Period Ended | Payment Date | Cents per Security |

|---|---|---|

| Half year ended 30 June 2020 | 28 August 2020 | 9.30 |

| Half year ended 31 December 2020 | 26 February 2021 | 13.20 |

Annual Tax Statements

The Annual Tax Statement for the year ending 30 June 2021 has been provided to investors. The components of the distribution on a cents per security basis for the year are provided below:

| Period Ended | 30 Jun 2020 | 31 Dec 2020 | Total Distribution | Total Distribution (%) |

|---|---|---|---|---|

| Rate (cents per security) | 9.30 | 13.20 | 22.50 | 100.00% |

| Australian Assessable income (interest income) | 0.227662 | 0.272245 | 0.499907 | 2.2% |

| Australian Assessable income (other income) | 3.325200 | 5.745073 | 9.070273 | 40.3% |

| Net capital gain (Discounted TAP) | 0.000000 | 6.439500 | 6.439500 | 28.6% |

| Non-Assessable Amount | 5.747138 | 0.743182 | 6.49032 | 28.8%1 |

| Total Distribution paid | 9.30 | 13.20 | 22.50 | 100.00% |

1. This represents the tax deferred for the trust which may be slightly different to the tax components for an individual investor.

Group Distribution Summary

GPT paid the following distributions to Securityholders during the year ending 30 June 2020:

| Period Ended | Payment Date | Cents per Security |

|---|---|---|

| Half year ended 30 June 2019 | 30 August 2019 | 13.11 |

| Half year ended 31 December 2019 | 28 February 2020 | 13.37 |

Annual Tax Statements

The Annual Tax Statement for the year ending 30 June 2020 have been provided to investors. The components of the distribution on a cents per security basis for the year are provided below:

| Period Ended | 30 Jun 2019 | 31 Dec 2019 | Total Distribution | Total Distribution (%) |

|---|---|---|---|---|

| Rate (cents per security) | 13.11 | 13.37 | 26.48 | 100.00% |

| Australian Assessable income (interest income) | 0.297543 | 0.258605 | 0.556148 | 2.1% |

| Australian Assessable income (other income) | 3.004480 | 6.080664 | 9.085144 | 34.3% |

| Non-Assessable Amount (AMIT cost base decrease amount) | 9.807977 | 7.030731 | 16.838708 | 63.6%1 |

| Total Distribution paid | 13.11 | 13.37 | 26.48 | 100.00% |

1. This represents the tax deferred for the trust which may be slightly different to the tax component for an individual investor.

Guide to Annual Tax Statement

A Guide to The GPT Group 2020 Annual Tax Statement was mailed with the 2020 Annual Tax Statement to assist investors in completing their tax returns, and a copy is also available to download here: Guide to The GPT Group Annual Tax Statement 2020

Group Distribution Summary

GPT paid the following distributions to Securityholders during the year ending 30 June 2019:

| Period Ended | Payment Date | Cents per Security |

|---|---|---|

| Half year ended 30 June 2018 | 31 August 2018 | 12.61 |

| Half year ended 31 December 2018 | 28 February 2019 | 12.85 |

Annual Tax Statements

Annual Tax Statement for the year ending 30 June 2019 was mailed in March 2019. The taxation components of The GPT Group's distributions for the year are set out in the Annual Tax Statement. The components of the distribution on a cents per security basis for the year are provided below:

| Period Ended | 30 Jun 2018 | 31 Dec 2018 | Total Distribution | Total Distribution (%) |

|---|---|---|---|---|

| Rate (cents per security) | 12.61 | 12.85 | 25.46 | 100.00% |

| Australian Assessable income (interest income) | 0.316566 | 0.105782 | 0.422348 | 1.66% |

| Australian Assessable income (other income) | 5.908821 | 5.677426 | 11.586247 | 45.51% |

| Non-Assessable Amount (AMIT cost base decrease amount) | 6.384613 | 7.066792 | 13.451405 | 52.83%1 |

| Total Distribution paid | 12.61 | 12.85 | 25.46 | 100.00% |

1. This represents the tax deferred for the trust which may be slightly different to the tax component for an individual investor.

Guide to Annual Tax Statement

A Guide to The GPT Group 2019 Annual Tax Statement was mailed with the 2019 Annual Tax Statement to assist investors in completing their tax returns, and a copy is also available to download here: Guide to The GPT Group Annual Tax Statement 2019

Group Distribution Summary

GPT paid the following distributions to Securityholders during the year ending 30 June 2018:

| Period Ended | Payment Date | Cents per Security |

|---|---|---|

| Half year ended 30 June 2017 | 31 August 2017 | 12.3 |

| Half year ended 31 December 2017 | 28 February 2018 | 12.3 |

Annual Tax Statements

Annual Tax Statement for the year ending 30 June 2018 was mailed in March 2018. The taxation components of The GPT Group's distributions for the year are set out in the Annual Tax Statement. The components of the distribution on a cents per security basis for the year are provided below:

| Period Ended | 30 Jun 2017 | 31 Dec 2017 | Total Distribution |

|---|---|---|---|

| Rate (cents per security) | 12.3 | 12.3 | 24.6 |

| Australian Assessable income (interest income) | 0.546369 | 0.549748 | 1.096117 |

| Australian Assessable income (other income) | 6.360712 | 4.340127 | 10.700839 |

| Non-Assessable Amount (AMIT cost base decrease amount) | 5.392919 | 7.410125 | 12.803044 |

| Total Distribution paid | 12.3 | 12.3 | 24.6 |

Guide to Annual Tax Statement

A Guide to The GPT Group 2018 Annual Tax Statement was mailed with the 2018 Annual Tax Statement to assist investors in completing their tax returns, and a copy is also available to download here: Guide to The GPT Group Annual Tax Statement 2018

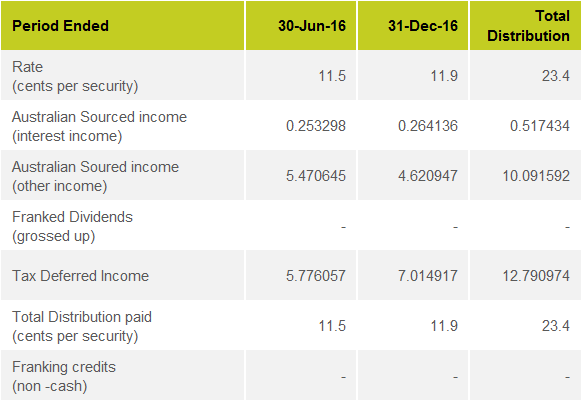

Group Distribution Summary

GPT paid the following distributions to Securityholders during the year ending 30 June 2017:

| Period Ended | Payment Date | Cents per Security |

|---|---|---|

| Half year ended 30 June 2016 | 31 August 2016 | 11.5 |

| Half year ended 31 December 2016 | 28 February 2017 | 11.9 |

Annual Tax Statements

Annual Tax Statement for the year ended 30 June 2017 was mailed in July 2017. The taxation components of The GPT Group's distributions for the year are set out in the Annual Tax Statement. The components of the distribution on a cents per security basis for the year are provided below:

Guide to Annual Tax Statement

A Guide to The GPT Group 2017 Annual Tax Statement was mailed with the 2017 Annual Tax Statement to assist investors in completing their tax returns, and a copy is also available to download here: Guide to The GPT Group Annual Tax Statement 2017

Group Distribution Summary

GPT paid the following distributions to Securityholders during the year ending 30 June 2016 (no company dividend was paid):

| Period Ended | Payment Date | Cents per Security |

|---|---|---|

| Half year ended 30 June 2015 | 11 September 2015 | 11.0 |

| Half year ended 31 December 2015 | 29 February 2016 | 11.5 |

Annual Tax Statements

Annual Tax Statements for the year ended 30 June 2016 were mailed in July 2016. The taxation components of The GPT Group's distributions for the year are set out in the Annual Tax Statement. The components of the distribution on a cents per security basis for the year are provided below:

| Period Ended | 30 Jun 2015 | 31 Dec 2015 | Total Distribution |

|---|---|---|---|

| Rate / Cents per unit | 11.0 | 11.5 | 22.5 |

| Australian Sourced income (interest income) | 0.197752 | 0.245139 | 0.442891 |

| Australian Soured income (other income) | 5.532185 | 3.623253 | 9.155438 |

| Franked Dividends (grossed up) | 0.000594 | 0.000324 | 0.000918 |

| Tax Deferred Income | 5.269469 | 7.631284 | 12.900753 |

| Total Distribution paid | 11.0 | 11.5 | 22.5 |

| Franking credits (non -cash) | 0.000178 | 0.000097 | 0.000275 |

Guide to Annual Tax Statement

A Guide to The GPT Group 2016 Annual Tax Statement was mailed with the 2016 Annual Tax Statement to assist investors in completing their tax returns, and a copy is also available to download here: Guide to The GPT Group Annual Tax Statement 2016

Distribution Summary

GPT paid the following distributions to Securityholders during the year ending 30 June 2015 (no company dividend was paid):

| Period Ended | Payment Date | Cents per Security |

|---|---|---|

| Half year ended 30 June 2014 | 12 September 2014 | 10.5 |

| Half year ended 31 December 2014 | 27 March 2015 | 10.7 |

Annual Tax Statements

Annual Tax Statements for the year ended 30 June 2015 were mailed in July 2015. The taxation components of The GPT Group's distributions for the year are set out in the Annual Tax Statement. The components of the distribution on a cents per security basis for the year are provided below:

| Period Ended | 30 Jun 2014 | 31 Dec 2014 | Total Distribution |

|---|---|---|---|

| Rate / Cents per unit | 10.5 | 10.7 | 21.2 |

| Australian Sourced income (interest income) | 0.893217 | 0.000000 | 0.893217 |

| Australian Soured income (other income) | 4.588741 | 4.278473 | 8.867214 |

| Foreign Sourced Income | 0.008048 | 0.007447 | 0.015495 |

| Tax Deferred Income | 5.009994 | 6.414080 | 11.424074 |

| Total Distribution paid | 10.5 | 10.7 | 21.2 |

Guide to Annual Tax Statement

A Guide to The GPT Group 2015 Annual Tax Statement was mailed with the 2015 Annual Tax Statement to assist investors in completing their tax returns, and a copy is also available to download here: Guide to The GPT Group Annual Tax Statement 2015

Group Distribution Summary

GPT paid the following distributions to Securityholders during the year ending 30 June 2014 (no company dividend was paid):

| Period Ended | Payment Date | Cents per Security |

|---|---|---|

| Quarter ended 31 March 2013 | 17 May 2013 | 5.1 |

| Quarter ended 30 June 2013 | 13 September 2013 | 5.0 |

| Half year ended 31 December 2013 | 14 March 2014 | 10.3 |

Annual Tax Statements

Annual Tax Statements for the year ended 30 June 2014 were mailed in July 2014. The taxation components of The GPT Group's distributions for the year are set out in the Annual Tax Statement. The components of the distribution on a cents per security basis for the year are provided below:

| Period Ended | 31 Mar 2013 | 30 Jun 2013 | 31 Dec 2013 | Total Distribution |

|---|---|---|---|---|

| Rate / Cents per unit | 5.10 | 5.00 | 10.30 | 20.40 |

| Australian Sourced income | 0.00 | 0.00 | 0.00 | 0.00 |

| Capital Gains | 0.00 | 0.00 | 0.00 | 0.00 |

| Foreign Sourced Income | 0.00 | 0.00 | 0.00 | 0.00 |

| Tax Deferred Income | 5.10 | 5.00 | 10.30 | 20.40 |

| Total Distribution paid | 5.10 | 5.00 | 10.30 | 20.40 |

Guide to Annual Tax Statement

A Guide to The GPT Group 2014 Annual Tax Statement was mailed with the 2014 Annual Tax Statement to assist investors in completing their tax returns, and a copy is also available to download here: Guide to The GPT Group Annual Tax Statement 2014

Group Distribution Summary

GPT paid the following distributions to Securityholders during the year ending 30 June 2013 (no company dividend was paid):

| Quarter Ended | Payment Date | Cents per Security |

|---|---|---|

| 30 June 2012 | 7 September 2012 | 4.9 |

| 30 September 2012 | 16 November 2012 | 4.7 |

| 31 December 2012 | 15 March 2013 | 5.1 |

Annual Tax Statements

Annual Tax Statements for the year ended 30 June 2013 were mailed in July 2013. The taxation components of The GPT Group's distributions for the year are set out in the Annual Tax Statement. The components of the distribution on a cents per security basis for the year are provided below:

| Quarter Ended | 30 Jun 2012 | 30 Sep 2012 | 31 Dec 2012 | Total Distribution |

|---|---|---|---|---|

| Rate / Cents per unit | 4.90 | 4.70 | 5.10 | 14.70 |

| Australian Sourced income | 0.00 | 0.00 | 0.00 | 0.00 |

| Capital Gains | 0.00 | 0.00 | 0.00 | 0.00 |

| Foreign Sourced Income | 0.00 | 0.00 | 0.00 | 0.00 |

| Tax Deferred Income | 4.90 | 4.70 | 5.10 | 14.70 |

| Total Distribution paid | 4.90 | 4.70 | 5.10 | 14.70 |

Guide to Annual Tax Statement

A Guide to The GPT Group 2013 Annual Tax Statement was mailed with the 2013 Annual Tax Statement to assist investors in completing their tax returns, and a copy is also available to download here: Guide to The GPT Group Annual Tax Statement 2013

Group Distribution Summary

GPT paid the following distributions to Securityholders during the year ending 30 June 2012 (no company dividend was paid):

| Quarter Ended | Payment Date | Cents per Security |

|---|---|---|

| 30 June 2011 | 23 September 2011 | 4.3 |

| 30 September 2011 | 18 November 2011 | 4.4 |

| 31 December 2011 | 16 March 2012 | 4.9 |

| 31 March 2012 | 25 May 2012 | 4.6 |

Annual Tax Statements

Annual Tax Statements for the year ended 30 June 2012 were mailed in July 2012. The taxation components of The GPT Group's distributions for the year are set out in the Annual Tax Statement. The components of the distribution on a cents per security basis for the year are provided below:

| Quarter Ended | 30 Jun 2011 | 30 Sep 2011 | 31 Dec 2011 | 31 Mar 2012 | Total Distribution |

|---|---|---|---|---|---|

| Rate / Cents per unit | 4.30 | 4.40 | 4.90 | 4.60 | 18.2 |

| Australian Sourced income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Capital Gains | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Foreign Sourced Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Tax Deferred Income | 4.30 | 4.40 | 4.90 | 4.60 | 18.2 |

| Total Distribution paid | 4.30 | 4.40 | 4.90 | 4.60 | 18.2 |

Guide to Annual Tax Statement

A Guide to The GPT Group 2012 Annual Tax Statement was mailed with the 2012 Annual Tax Statement to assist investors in completing their tax returns, and a copy is also available to download here: Guide to The GPT Group Annual Tax Statement 2012

Group Distribution Summary

GPT paid the following distributions to Securityholders during the year ending 30 June 2011 (no company dividend was paid):

| Quarter Ended | Payment Date | Cents per Security |

|---|---|---|

| 30 June 2010 | 24 September 2010 | 4.100000 |

| 30 September 2010 | 26 November 2010 | 4.100000 |

| 31 December 2010 | 25 March 2011 | 4.600000 |

| 31 March 2011 | 27 May 2011 | 4.200000 |

Annual Tax Statements

Annual Tax Statements for the year ended 30 June 2011 were mailed in July 2011. The taxation components of The GPT Group's distributions for the year are set out in the Annual Tax Statement. The components of the distribution on a cents per security basis for the year are provided below:

| Quarter Ended | 30 Jun 2010 | 30 Sep 2010 | 31 Dec 2010 | 31 Mar 2011 | Total Distribution |

|---|---|---|---|---|---|

| Rate / Cents per unit | 4.10 | 4.10 | 4.60 | 4.20 | 17.0 |

| Australian Sourced income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Capital Gains | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Foreign Sourced Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Tax Deferred Income | 4.10 | 4.10 | 4.60 | 4.20 | 17.0 |

| Total Distribution paid | 4.10 | 4.10 | 4.60 | 4.20 | 17.0 |

Guide to Annual Tax Statement

A Guide to The GPT Group 2011 Annual Tax Statement was mailed with the 2011 Annual Tax Statement to assist investors in completing their tax returns, and a copy is also available to download here: Guide to The GPT Group Annual Tax Statement 2011

Group Distribution Summary

GPT paid the following distributions to Securityholders during the year ending 30 June 2010 (no company dividend was paid):

| Quarter Ended | Payment Date | Cents per security |

|---|---|---|

| 30 June 2009 | 25 September 2009 | 0.900000 |

| 30 September 2009 | 27 November 2009 | 1.000000 |

| 31 December 2009 | 26 March 2010 | 1.000000 |

| 31 March 2010 | 11 May 2010 | 0.700000 |

Annual Tax Statements

Annual Tax Statements for the year ended 30 June 2010 were mailed in July 2010. The taxation components of The GPT Group's distributions for the year are set out in the Annual Tax Statement. The components of the distribution on a cents per security basis for the year are provided below:

| Quarter ended | 30-Jun-09 | 30-Sep-09 | 31-Dec-09 | 31-Mar-10 | Total Distribution |

|---|---|---|---|---|---|

| Rate / cents per unit | 0.90 | 1.00 | 1.00 | 0.70 | 3.60 |

| Australian sourced income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Capital Gains | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Foreign Sourced Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Tax Deferred Income | 0.90 | 1.00 | 1.00 | 0.70 | 3.60 |

| Total Distribution Paid | 0.90 | 1.00 | 1.00 | 0.70 | 3.60 |

Guide to Annual Tax Statement

A Guide to The GPT Group 2010 Annual Tax Statement was mailed with the 2010 Annual Tax Statement to assist investors in completing their tax returns, and a copy is also available to download here: Guide to The GPT Group Annual Tax Statement 2010

Further Information regarding the BGP In Specie Dividend

Annual Tax Statements

Current and previous investors can click here to login to the Link Market Services registry and download your Annual Tax Statement.

You will need your SRN/HIN, surname and postcode to complete the login process.

MIT Fund Payment Notices

Current and previous MIT fund payment notices can be accessed here.

Tax Transparency

The GPT Group is committed to managing its tax obligations responsibly and in compliance with all laws and regulations.

The Board of Taxation has released a Tax Transparency Code (“TTC”) that recommends a set of principles and minimum standards on the disclosure of tax information for businesses.

The GPT Group has voluntarily adopted the TTC recommendations and publishes this document as part of the Group’s commitment to tax transparency.

A copy of GPT's Tax Transparency Report can be downloaded here: GPT Tax Transparency - 2020

Please see below for previous Tax Transparency Reports:

GPT Tax Transparency Report - 2018

Capital Gains Tax and Net Tangible Assets

A GPT Group stapled security comprises two separate assets for capital gains tax purposes; a General Property Trust unit and a GPT Management Holdings Limited share.

For capital gains tax purposes you need to apportion the cost of each stapled security and the proceeds of sale of each stapled security over the separate assets that make up the stapled security. This apportionment should be done on a reasonable basis.

One possible method of apportionment is on the basis of the relative net assets of the individual entities. Click here to view detailed information on GPT's Net Tangible Asset (NTA) backing.

What is AMIT?

- The AMIT regime is a specific tax regime for managed investment trusts. General Property Trust (“GPT”) has become an AMIT from 1 January 2017.

Will the AMIT regime affect GPT’s distribution policy?

- No. GPT does not intend to change its distribution policy as a consequence of becoming an AMIT.

Will the AMIT regime change the way I fill out my tax return?

- No. You are still be required to include your share of GPT’s taxable income, by component type, in your personal tax return.

- An Annual Tax Statement (AMIT Annual Member Statement) will continue to be provided to you to assist in preparing your tax return.

How does this impact GPT Group investors?

Investors may be impacted in two key ways:

The allocation of GPT’s taxable income to investors will change from a “present entitlement” basis to an “attribution” basis.

- Under the AMIT regime, GPT’s taxable income is “attributed” to investors on a fair and reasonable basis.

- GPT will attribute taxable to income to investors in the same proportion as the cash distributed to each investor for the relevant year. There should be no adverse change in your personal tax as a consequence of GPT becoming an AMIT.

Investors’ capital gains tax (“CGT”) cost base in their GPT units can go up as well as go down.

- Under the tax law that applies to investors of AMITs, investors can receive a “step up” in their CGT cost base when the taxable income “attributed” to an investor is more than the cash distribution received from GPT. This adjustment is referred to as an “AMIT cost base net increase amount”. If this situation arises, investors will avoid the imposition of double taxation on amounts attributed to them but not paid as a distribution.

- If applicable, GPT will issue investors with details of “AMIT cost base net decrease amounts” or “AMIT cost base net increase amounts” for that year.

Will the AMIT regime change the way in which GPT’s income is taxed?

- No. The overall manner in which GPT’s income is taxed should not change.

What will I need to do?

- The GPT Group will provide investors with an Annual Tax Statement that complies with taxation obligations to enable investors to complete their tax returns.

How are my stapled securities impacted by the Security Consolidation?

The GPT Group undertook a consolidation of its stapled securities in May 2010 (Consolidation) which broadly resulted in every five stapled securities held by a Securityholder being merged (ie consolidated) into one stapled security. The economic interest in the GPT Group held by individual Securityholders should not change but the value of the Group is now split amongst fewer stapled securities.

The Consolidation should not result in a CGT event occurring however, the Consolidation will affect the tax cost base of your GPT stapled securities. Broadly, the tax cost base of your consolidated GPT stapled securities should be equal to the sum of the cost bases of your original GPT stapled securities as merged in the ratio of 5 to 1.

For further information, please refer to the “Consolidation of Securities Key Taxation Principles” document.

I received an In-Specie Dividend in 2009, is there further information on this?

This information is for GPT Securityholders who held GPT stapled securities at 7:00pm on 12th August 2009 and therefore received shares in BGP Holdings Limited (BGP) as part of the In Specie Dividend from GPT Management Holdings Limited (GPTMH).

The In-Specie Dividend is a de-merger and is not assessable for Australian income tax purposes. However, a consequence of the de-merger is that the tax cost base of your GPTMH shares held at that time should be reallocated to the shares received in BGP, based on the relative market value of GPTMH and BGP following the de-merger. The tax cost base of your units in GPT Trust will not change.

Please refer to the “In Specie Dividend capital gains tax cost base implications” document for further and more detailed information.

The website does not provide a split in NTA between the GPT Trust and GPT Management holdings prior to 2005, why is that?

A: GPT Management Holdings Limited (GPTMH) was established in 2005 and its shares were stapled to the units in General Property Trust (GPT Trust). Prior to 2005, GPTMH did not exist so the GPT Group did not have stapled securities.

Securityholders only held units in GPT Trust, so there was no need to provide a split of the NTA between GPT Trust and GPTMH.

The Foreign Account Tax Compliance Act (FATCA) is a United States (US) federal law designed to track US Persons who may be avoiding tax liabilities by holding assets overseas. Australia signed an Intergovernmental Agreement (IGA) with the US in April 2014 to assist in the implementation of FATCA for Australian financial institutions.

Under Australian law Australian financial institutions are required to report FATCA information to the Australian Taxation Office (ATO). Under the FATCA rules The GPT Group is taken to be an Australian financial institution and accordingly has to report information about certain securityholders to the ATO annually. The ATO will provide this information to the US Internal Revenue Service.

The FATCA information reported is only in respect of the holding in The GPT Group by US Persons or holdings of investors who have not certified that they are not US Persons. In order to comply with the FATCA reporting obligations The GPT Group will ask investors to certify their FATCA status.

1. What is FATCA?

FATCA stands for Foreign Account Tax Compliance Act and it is a United States (US) law designed to track US Persons who may be avoiding tax liabilities by holding assets overseas.

2. Why does this impact The GPT Group securityholders?

Australia signed an Intergovernmental Agreement (IGA) with the US in April 2014 to assist in the implementation of FATCA for Australian financial institutions. Under Australian law The GPT Group is required to report FATCA information to the Australian Taxation Office in respect of:

- securityholders who acquired The GPT Group stapled securities during the period from 1 July 2014 to 31 December 2015 and who continue to hold a balance of The GPT Group stapled securities on 1 January 2016; and

- securityholders who acquire The GPT Group stapled securities on or after 1 January 2016.

3. What information will be reported?

The following information will be reported to the Australian Taxation Office:

i) Name and address of the securityholder;

ii) Taxpayer Identification Number (TIN), if one has been provided;

iii) Amounts paid to the securityholder during the relevant calendar year;

iv) Value of securityholding at 31 December 2016 and annually thereafter; and

vi) In respect of U.S. controlling persons:

- Name of U.S. controlling person; and

- TIN of U.S. controlling person

4. Does FATCA impact on my GPT Group stapled securities held on the ASX?

No, FATCA should not impact on your ability to acquire, hold or dispose of The GPT Group stapled securities. In addition, FATCA does not impact on the payment of distributions to you by The GPT Group.

However, The GPT Group securityholders will be contacted to certify if they are a US Person or an entity that is controlled by US Persons. If securityholders are US Persons or fail to certify that they are not US Persons then The GPT Group will report the information required under FATCA to the Australian Taxation Office.

5. What will I need to do?

From January 2016 onwards The GPT will be sending securityholders requests to certify their status under the FATCA rules. Please read the request carefully and complete the FATCA self-certification.

6. Who do I contact if I have further questions about this?

For further information please call The GPT Group’s Securityholder Service Centre on 1800 025 095.

Other Useful Documents

Below is a selection of documents that may be of use to investors when reviewing their tax affairs.